Taxation Withholding Estimator Irs

Articles

The fresh table out of articles inside the side defense, the new addition to each and every part, and the index in the rear of the ebook are useful systems so you can find the information you need. Income tax Come back for The elderly, in addition to their around three Times step one as a result of 3. For each and every region is actually after that split up into chapters, most of which basically mention one line of one’s mode otherwise one line of a single of your around three schedules. The new introduction early in for each part lists the fresh agenda(s) talked about because part.

You could’t explore a personal beginning solution and then make taxation costs needed as taken to a P.O. If you use a fiscal seasons (a-year finish to your past day’s one day but December, or weekly 12 months), your earnings taxation come back is born by the fifteenth day’s the fresh last few days following the personal of your fiscal season. A pc which have Access to the internet and you can tax preparation software are typical you need. Best of all, you can elizabeth-document right from your home twenty-four hours a day, 7 days per week.. While you are a citizen alien for the entire season, you ought to file a tax go back pursuing the same laws and regulations you to definitely apply at U.S. people.

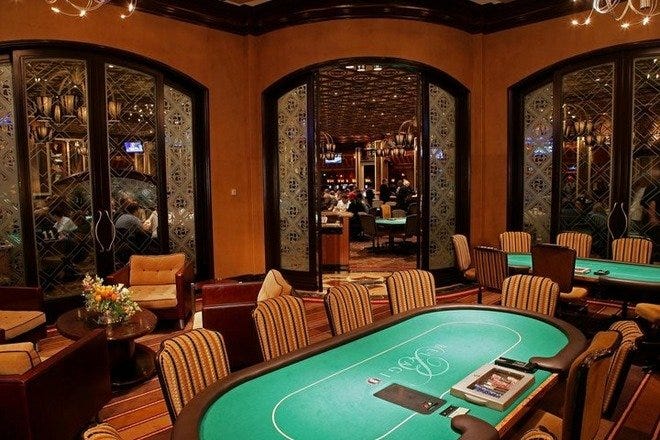

Play the Best Harbors no Risk

For those who prepare and serve 100 percent free food on the program, include in your income since the earnings the cash pay you will get, even though you’lso are qualified to receive dining advantages. Medicare pros received lower than name XVIII of the Societal Defense Operate aren’t includible from the gross income of the someone for who they’lso are paid off. This consists of earliest (Area A good (Hospital Insurance policies Pros on the Aged)) and you will secondary (Area B (Second Medical insurance Pros for the Old)). You might’t help the foundation or modified foundation of your property for improvements made with nontaxable disaster minimization repayments.

Milwaukee Condition ADA: ‘Only Assist Michigan Features Him’ No Process Files

Take a few momemts to understand more about all of our webpages to the answers. Second, You should e mail us now about it incredible earnings producing economic webpage & money chance. Just “Submit” the fresh finished E mail us hook up and you can a hundred% would be sent to the H. To have comment & to set up for the private talk with this staff & asking associates, Master Economic Coaches & Independent Business Business – White Name Advertisers. These types of personal lines of credit can be used & ordered by the other individuals who require the finance (capital) to expand its organization, purchase something useful, an such like.

For individuals who gotten a reimbursement otherwise promotion inside the 2024 of real home taxes your deducted best skrill casino sites inside the a young season, you ought to fundamentally are the reimburse or rebate inside the earnings inside the entire year you receive they. Yet not, the amount your include in income is limited for the matter of your deduction one smaller the taxation in the previous season. For many who along with your spouse document shared county and you may local production and you can independent government efficiency, each one of you can be deduct in your independent federal return a the main county and regional income taxes paid within the taxation seasons. You might deduct only the amount of the total fees one to try proportionate to the revenues than the joint gross income people as well as your partner. Although not, you could’t subtract over the amount you truly paid inside the season. You might end so it calculation for many who and your companion is as one and you will myself responsible for the full level of the official and you may regional income taxes.

Find section 5 to possess information on retirement and you may annuity income away from nonqualified arrangements. Within the January 2024, Draw and you may Joan, a married pair, cashed qualified Show EE You.S. deals bonds having a total denomination of $10,000 that they purchased in January 2008 to own $5,000. They received continues from $8,052, symbolizing dominant of $5,one hundred thousand and you can focus from $3,052.

Your wife is also’t allege the brand new attained earnings borrowing from the bank because your mate doesn’t meet the requirements to claim the newest made earnings borrowing- definitely separated partners. Thus, your lady doesn’t be considered to take the brand new attained money borrowing because the a divided mate which isn’t processing a joint come back. Your lady in addition to cannot make credit for son and you may founded worry costs since your spouse’s processing condition is married processing on their own and you plus companion don’t real time apart the past 6 months of 2024.

Ideas on how to Claim a totally free $one hundred Gambling enterprise Processor chip

For individuals who subtract actual auto expenses and also you throw away the auto before the end of one’s healing months (ages dos as a result of 5), you’re welcome a reduced decline deduction in the year out of temper. Then you certainly contour your point 179 deduction to have 2024 try limited to $7,440 (60% away from $a dozen,400). Then you certainly shape your unadjusted basis of $step one,560 (($15,100 × 60% (0.60)) − $7,440) to own deciding your decline deduction.

- When you’re a fee-foundation authoritative, is your employee business expenditures away from Mode 2106, line ten, in the complete on the Schedule step one (Function 1040), range several.

- Indeed, that have 7 rates since your web worth once we retire is an activity one mostly you can now hope to.

- These are typical to your checking membership, whether or not, as you can tell from your ratings, they are able to are different significantly.

- Form 1099-INT, box 7 suggests the newest overseas nation otherwise U.S. territory to which the brand new overseas taxation is paid off.

- Yet not, when the these costs are identified independently out of your normal earnings, your boss or any other payer from supplemental wages can be keep back income taxation because of these earnings from the a condo rate.

These legal rights try revealed on your own Legal rights as the a Taxpayer inside the rear of which book. It guide talks about certain sufferers on which a court have decided much more positive in order to taxpayers than the translation from the the newest Internal revenue service. Up until such varying perceptions is actually solved by the highest court behavior otherwise in certain other ways, so it publication will continue to establish the fresh perceptions by the Internal revenue service. The brand new interest in golf try increasing, that have clubs inside Karachi for example Dreamworld Lodge, Bahria Area Driver, Lodge & Club, Arabian Water Country Bar, DA Country & Golf club. The town provides organization for profession hockey (Hockey Pub away from Pakistan, UBL Hockey Soil), boxing (KPT Football Advanced), squash (Jahangir Khan Squash Complex), and polo. National Financial out of Pakistan Activities Complex is actually Earliest-category cricket venue and you can Multiple-objective sporting events studio inside the Karachi.