Necessary lowest shipment $1 deposit bonus codes 2025 worksheets Irs

Articles

Legislation brings penalties to possess failure to help you document output otherwise pay taxes as needed. If the come back are changed unconditionally, it might affect a state tax liability. For example transform produced down seriously to an examination of your go back from the Irs. Keep information in accordance with assets through to the period of restrictions expires to your season the place you dispose of the property inside the an excellent nonexempt disposition.

Financial terms | $1 deposit bonus codes 2025

However, you might have to show the expenditures if any of the after the criteria implement. In case your get back is tested, you may need to give considerably more details to your Irs. This short article might possibly be must explain or even to present the brand new accuracy otherwise accuracy of information contained in your own information, statements, testimony, otherwise documentary research just before an excellent deduction is actually welcome. $1 deposit bonus codes 2025 Your don’t always have to listing title of each and every person away from a present. A general number will be enough when it is clear you to your aren’t looking to avoid the $twenty-five yearly restriction for the number you can subtract to possess gifts to any one individual. Such, if you buy 1000s of passes to help you regional highest school basketball video game and give two tickets to each and every of a lot people, it’s always sufficient to number a broad breakdown of one’s recipients.

Which are the benefits of choosing a low put local casino?

Sports bettors may use these types of invited bonuses so you can bet on an excellent substantial kind of football. Very playing networks constantly modify the also provides and lots of have to have the access to coupons to claim. Be sure to recommend to this article web page away from Props.com to find latest discounts for use on the greatest on line sportsbooks around the country. Some on the web wagering web sites draw in you to refer members of the family to them because of recommendation bonuses. A recommendation sportsbook bonus advantages your per pal sent to the new provided gaming site.

Best commission strategies for $step 1 gambling enterprise dumps

However they were almost every other expenditures in connection with the area away from employment that enable the newest employee to operate. 463, Travel, Present, and you may Vehicle Costs, for lots more facts. Any other allowable taxation is subtracted for the Schedule A good (Function 1040), line 6. These are taxation imposed in the one to rate to the retail transformation of an over-all set of kinds from things. These are taxes imposed from the 50 says, U.S. areas, or any one of their political subdivisions (such as a district or city), or by Region away from Columbia. Play with Table 11-step one because the a guide to figure out which fees you might deduct.

Automobile Provided by Your employer

Please remember one to regardless of the type of extra your allege, small print still pertain. For more information, here are a few our very own point for the $one hundred Totally free Chip No-deposit Incentive Legislation. Whether or not Insane.io is relatively the newest, it’s a good crypto casino. At The new Local casino Wizard, we’d also go in terms of to say it’s our highest-rated casinos.

If the a federal government agency, standard bank, otherwise credit relationship cancels otherwise forgives a financial obligation your debt from $600 or more, you are going to discover an application 1099-C, Cancellation away from Debt. Basically, you declaration which earnings for the Schedule C (Form 1040), Profit otherwise Losses From Team. But not, if the negotiate concerns an exchange away from something aside from characteristics, for example inside the Example 3 less than, you may need to play with another function otherwise plan instead. More 50% away from Jamie’s net advantages try taxable while the earnings on the internet 8 of one’s worksheet ($forty five,500) is more than $forty two,000. (Come across Restrict nonexempt part under How much Is actually Nonexempt, before.) Jamie and you can Jessie enter into $10,100000 to your Setting 1040, line 6a; and you may $six,275 to your Function 1040, range 6b. If the term “benefits” is employed inside section, it pertains to each other social security professionals and also the SSEB portion from level 1 railroad pensions.

You could be able to allege the parent because the a dependent should your revenues and you will service screening try came across. The details are identical as in Example 2, except your friend got earnings of $8,one hundred thousand within the seasons and you will advertised the newest made earnings borrowing from the bank. Your pal’s man ‘s the qualifying kid of some other taxpayer (your own buddy), in order to’t allege the buddy’s son as your qualifying relative. In addition to, you could’t allege their friend as your being qualified cousin by the revenues sample, explained later. Your, your wife, as well as your 10-year-old son all lived-in the united states for all from 2024. On the August step one, 2024, your lady went from the family.

Taxation had been taken off its shell out, so that they submitted a mutual get back only to rating a refund of your withheld taxes. The new exception for the joint go back try applies, which means you are not disqualified out of claiming all of them as the an excellent founded because they document a mutual get back. You might claim each since the a depending when the all the additional tests to accomplish this is actually satisfied. Lead Document is a long-term option for taxpayers to help you document federal tax returns online—100percent free—in person and you will properly to the Irs from 2025. Head Document are a great filing choice for taxpayers within the playing states who have not too difficult tax returns reporting only certain types of earnings and you can saying particular credit and deductions.

For example, for individuals who claim a 20% cashback extra and eliminate $a hundred, you may get right back $20. Cashback bonuses are usually targeted at big spenders and you will is barely produced for $1 places. Free revolves grant you a selected quantity of spins to make use of to your a slot games (or set of) which might be free of charge. You will find several $step one incentives offered by greatest-rated gambling enterprises offering 1000s of free spins, including 80 free revolves on the Wacky Panda from the JackpotCity Casino. NerdWallet, Inc. is actually an independent blogger and you may research solution, perhaps not an investment mentor.

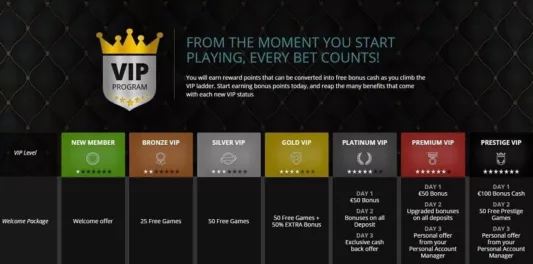

Although not, you will need to know the particulars of these also provides to help you optimize your on the web sense and possess the best value to suit your deposit. Whether you are searching for free revolves, deposit matches, otherwise VIP benefits, there’s an advantage that is correct to you personally. Rip Area are a different modern favourite certainly one of Canadian people. So it anime-style position features crazy kitties, gritty cityscapes, and two novel added bonus video game that provide lots of chances to winnings big. Ranging from $0.ten for each and every twist, it’s accessible also to the an excellent $step one put and offers volatile game play with high volatility and elegant animated graphics. Your own and you will economic data is covered by increased encryption and defense standards.

NIL refers to the entry to students-athlete’s identity, image, otherwise likeness to have industrial intentions as a result of selling and you may advertising and marketing projects. Including things such as autograph signings, device endorsements, licensing and you may retail arrangements, doing promotional initiatives, social networking postings, teaching camps otherwise training, and a lot more. Most of the time, your statement royalties to some extent We out of Plan Elizabeth (Function 1040). Although not, for many who keep a working petroleum, fuel, otherwise mineral desire or come in organization as the a personal-operating blogger, inventor, musician, etc., report your income and you will expenditures to the Schedule C (Setting 1040). For many who recover people count that you subtracted within the a young seasons to your Plan A good (Form 1040), you need to essentially are the complete number of the brand new data recovery inside your revenue in you receive they.